High court enforcement is a serious issue to deal with the UK. This post will explain what high court enforcement is, who a high court enforcement officer is, what you should expect when visited by one, and what the enforcement process is like.

What is high court enforcement, and what are their officers instructed to do?

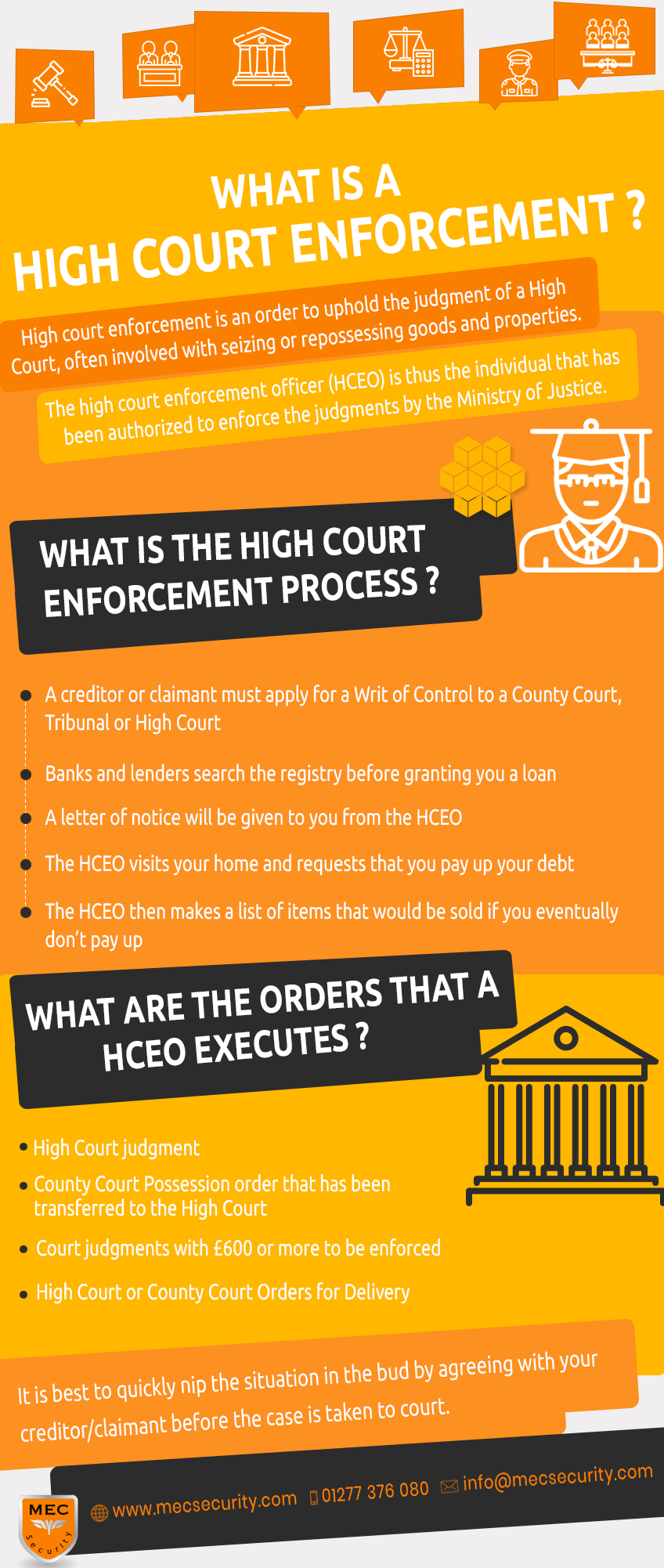

High court enforcement is an order to uphold the judgment of a High Court, often involved with seizing or repossessing goods and properties. The high court enforcement officer (HCEO) is thus the individual that has been authorized to enforce the judgments by the Ministry of Justice. You can think of HCEOs as bailiffs of the High Court, although with more power.

Formerly known as the Sheriff’s officers, HCEOs are issued a Writ of Execution that they must follow. The most common writ that HCEOS are given is a Writ of Control, previously known as the Writ of Fi Fa until 2014. This order instructs the officer to recover the money of the claimant from the debtor.

HCEOs cannot deal with debts like overdrafts, personal loans, and payday loans. However, they can recover non-regulated debts like business debts, rent arrears and tribunal awards.

An HCEO typically acts swiftly and is difficult to deal with on your own. You will be required to pay a fee upon their visit. This fee will include your debt as well as the cost the HCEO charges for doing his/her work. The sooner you settle the debts, the less the total fee and interest upon it.

What is the high court enforcement process?

- For the process to be initiated, a creditor or claimant must apply for a Writ of Control to a County Court, Tribunal or High Court. The order is registered with the Registry Trust and would remain in the register for six years. Banks and lenders search the registry before granting you a loan. This order tells the HCEO to visit you and request the payment of the debt.

- A letter of notice will be given to you from the HCEO informing you that he or she will give you a call. The practice is that a seven-day notice will be provided.

- After the seven-day notice is up, the HCEO visits your home and requests that you pay up your debt in full. If you cannot comply with this order, then they’ll confiscate your property. An HCEO may also visit your business property. In that case, they’ll confiscate your goods until you comply with the order.

- The HCEO then makes a list of items that would be sold if you eventually don’t pay up. If you are lucky, they will let you keep your goods and allow you to pay the debt in installments. This is called a controlled goods agreement. However, if you break the agreement, they will come back and remove the goods.

How is the payment made and what should you do if you do not agree to the fees?

There are many methods of paying the high court enforcement officer. The fees HCEO sets are based on the Taking Control of Goods (Fees) Regulations of 2014. If you do not agree to the fee they charge, then you can make a court application. However, you should tread this line carefully, and only take this path when you are absolutely sure that you are being charged for more than what is fair.

Interests run from the day that the High Court judgment is made or the County Court order is transferred till the day you pay up. The interest on your debt is in the Judgments Act and currently set at 8%. However, the amount you will be asked to pay may vary.

What are the orders that a High Court Enforcement Officer executes?

An HCEO can execute any;

- High Court judgment

- County Court Possession order that has been transferred to the High Court.

- Court judgments with £600 or more to be enforced.

- High Court or County Court Orders for Delivery.

Can you stop High Court Enforcement Officers from executing an order?

An HCEO cannot force their way into your house. However, if they have been in your home before and you have agreed to a controlled goods agreement, they can forcefully enter. Nevertheless, in your business property, they can use force to enter the premises.

You may also apply for a stay of execution if you can not reach an agreement with the HCEOs to pay the debt in installments.

A high court enforcement order will take much of your time and money in the end. It is best to quickly nip the situation in the bud by agreeing with your creditor/claimant before the case is taken to court.

Call us:

Call us:

Email us:

Email us: